Summary

A new trade understanding between China and Canada could mark a turning point for the global pulses market. Lower Chinese tariffs on Canadian agricultural products, particularly peas and canola, may allow Canadian exporters to raise prices, potentially triggering a broader recovery in pulse prices that have remained under pressure for over a year.

Trade Deal Reshapes Market Dynamics

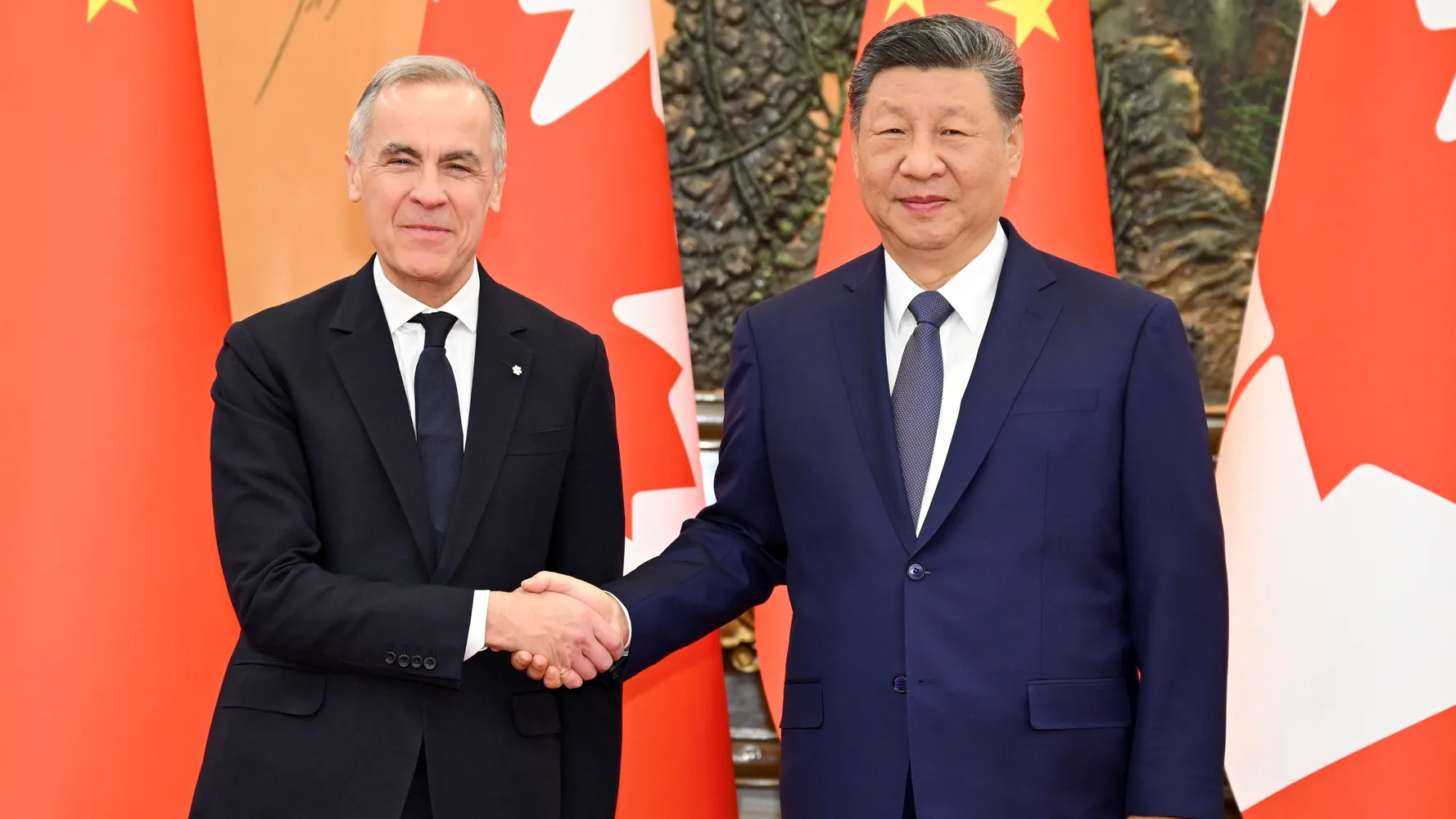

Last weekend, Canadian Prime Minister Mark Carney reached an agreement with Chinese President Xi Jinping in Beijing to ease trade frictions. Under the deal, China will lower duties on Canadian agricultural products in exchange for Canada reducing tariffs on Chinese electric vehicles.

Chinese tariffs on Canadian canola are expected to fall to around 15 per cent from March 1. Beijing will also remove anti-discrimination tariffs on Canadian canola meal, peas and seafood. In addition, China may step up imports of Canadian beef and animal genetics.

In return, Canada has allowed imports of 49,000 Chinese electric vehicles at a concessional tariff of 6.1 per cent under its most-favoured-nation framework.

Positive Signals for Canadian Growers

Canadian provinces have welcomed the development. Saskatchewan Premier Scott Moe said the agreement would restore trade flows and open new growth opportunities. Growers in Manitoba have also expressed optimism, especially after exports of canola and pork had nearly come to a halt in recent months. While pork is not yet explicitly covered, the market expects clarity in the coming weeks.

Although US President Donald Trump approved the agreement, reports suggest some unease within the US trade establishment over its broader implications.

Yellow Peas in Focus

The deal could allow Canada to raise yellow pea prices, a key factor influencing the global pulses market. Last week, Russia cut its yellow pea offers to China to $305 a tonne, while Canadian prices held steady at $310.

Canada had earlier reduced prices after China imposed a 100 per cent tariff. With tariffs now set to drop sharply to 6.1 per cent from March 1, Canadian exporters are likely to hike prices. Quality preferences also work in Canada’s favour, as Chinese buyers prefer Canadian peas over other origins.

Russia’s Role Will Be Crucial

Russia currently holds over 50 per cent market share in China’s pea imports and is sitting on nearly 700,000 tonnes of stocks due to weaker-than-expected Chinese buying. If Canadian prices rise, Russia’s response will be critical.

Should Russia also lift prices, it could spark a broader rebound across the pulses complex. Yellow peas have been the main drag on pulse prices for the past 18 months, and with weather risks building, the bearish phase may be nearing its end.

However, if Russia keeps prices low to clear inventories, the upward momentum in pulse prices could remain capped.

Conclusion

The Sino-Canada trade deal has the potential to shift the balance in the global pulses market. Lower tariffs, quality-driven demand and pricing power returning to Canada could help lift pulse prices. Much now depends on Russia’s pricing strategy and how quickly China ramps up purchases under the new framework.