Summary:

Recent developments in the global wheat market suggest a continued bearish trend in the short term, potentially leading to lower flour prices. This analysis examines three critical market indicators: China's declining imports, Algeria's recent purchasing patterns, and a significant market sell-off, while also considering potential risks to 2025 production.

1. China's Declining Wheat Imports

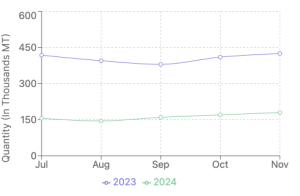

China's wheat imports have seen a dramatic 57% decline for the 2024-25 season (beginning September), with October marking the second consecutive month of decreased purchases. While the US Department of Agriculture projects Chinese imports at 12 million tonnes this year, current trends suggest lower volumes:

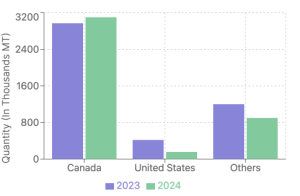

- US wheat sales to China have dropped to 155,700 tonnes (compared to 418,100 tonnes last year)

- Canadian wheat exports to China have increased to 3.1 million tonnes

- Market speculation suggests China may have secured a larger domestic wheat crop

This shift comes despite various global supply challenges, including:

- A smaller Russian crop

- Quality issues with European wheat

- Potential frost damage to Australian wheat

2. Algeria's Strategic Purchasing

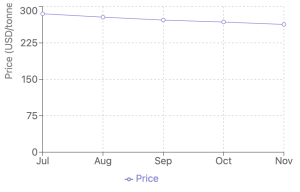

The Office Algérien Interprofessionnel des Céréales (OAIC) has made significant purchases at notably lower prices:

- Volume: 600,000 tonnes

- Price: $263 per tonne (cost and freight)

- Delivery: December 1-15 and December 16-31

- Sources: Multiple trade houses, primarily from the Black Sea region

- Expected beneficiaries: Bulgaria, Romania, and Ukraine

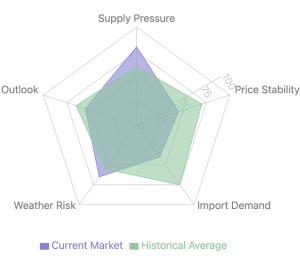

3. Market Sell-Off Dynamics

The wheat market has experienced a substantial sell-off over the past two weeks, primarily influenced by:

- Bearish trends in the corn market

- General market sentiment

- Trading patterns rather than fundamental crop conditions

Looking Ahead: Production Concerns

While current market indicators point to bearish trends, several risk factors for 2025 production deserve attention:

- Drought conditions affecting sowing in Ukraine and Russia

- Heavy rainfall disrupting European sowing operations

- Dry conditions in the United States

- Northern Hemisphere planting challenges

Conclusion

While immediate market indicators point to continued bearish trends in wheat prices, the market may be undervaluing significant risks to 2025 production. The disconnect between current pricing and future supply risks suggests potential market corrections could emerge around January 2025. Traders and buyers should carefully monitor Northern Hemisphere planting progress and weather conditions, as these factors could significantly impact market dynamics in the coming months.