In the dynamic landscape of global agricultural trade, China's pea market is undergoing significant transformation, presenting both challenges and opportunities for traders and investors. Recent market data reveals fascinating shifts in trade patterns and emerging trends that could reshape the industry's future.

Current Market Dynamics

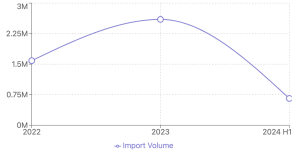

The first half of 2024 has witnessed a notable 22% decline in Chinese pea imports, with volumes dropping to 657,000 tonnes. This follows an exceptional 2023, where imports surged 64% to reach 2.6 million tonnes. This shift can be attributed to several key factors:

- Substantial inventory buildup from 2023's aggressive importing

- Currency fluctuations impacting trading margins

- Rising sea freight costs affecting overall logistics expenses

- Evolving trade policy landscape

Strategic Supply Chain Realignment

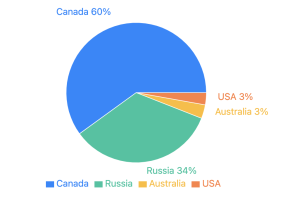

Perhaps the most significant development is the emergence of Russia as a dominant supplier, overtaking Canada's traditional position as the primary exporter of peas to China. The 2023 export breakdown reveals:

- Canada: 1.6 million tonnes

- Russia: 908,268 tonnes

- Australia: 84,247 tonnes

- United States: 74,820 tonnes

This realignment reflects broader changes in global trade dynamics and highlights the importance of maintaining diverse sourcing strategies in today's market.

Market Drivers and Future Outlook

Several fundamental factors are shaping the future of China's pea market:

Growing Health-Conscious Consumer Base

The younger Chinese demographic's increasing focus on healthy eating habits and sustainable lifestyles is driving demand for plant-based proteins. This trend is particularly significant given that:

- Over 80% of the Chinese population shows lactose intolerance symptoms

- East Asians are 40 times more likely to be lactose intolerant compared to Western populations

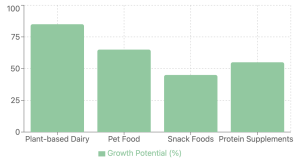

Expanding Alternative Protein Market

The market is witnessing substantial growth in:

- Plant-based dairy alternatives

- Nutritional health products

- Pet food and animal supply markets

Quality Differentiation

Despite overall market fluctuations, premium segments maintain strong demand:

- U.S. peas command premium pricing in snack food applications

- Quality consistency remains a key factor in buyer decisions

- Specialised markets like racing pigeon feed maintain stable demand

Strategic Implications for Traders

For agricultural commodity traders, these developments suggest several strategic considerations:

- Diversification of Supply Sources: The rise of new export markets necessitates broader sourcing strategies

- Quality Premium Opportunities: Different market segments show varying price sensitivities based on quality requirements

- Long-term Growth Potential: The expanding plant-based protein market presents sustained growth opportunities

Looking Ahead

While current import volumes show a temporary decline, the long-term outlook remains promising. The combination of:

- Growing health consciousness

- Increasing lactose intolerance awareness

- Rising environmental concerns

- Expanding plant-based food industry

suggests strong future growth potential in China's pea market.