Summary:

Recent frost damage in Australia has significantly affected the red lentils crop, leading to reduced production estimates and rising global prices. This situation, combined with a stronger Australian dollar, has shifted market focus to alternative suppliers like Canada and Russia. Despite these challenges, Australia is still expected to meet demand from major importers, but the global red lentils market is experiencing notable price increases and supply chain adjustments.

Recent Developments in Australia

1. Currency Fluctuation:

- Australian dollar has strengthened by 4% against the US dollar

- Typically, this would lead to lower commodity prices, but not in this case

2. Frost Damage:

- Severe frost has hit South Australia and Victoria

- Temperatures dropped as low as -5°C

- An estimated 400,000 tonnes of various crops affected

-

Impact on Red Lentils Market

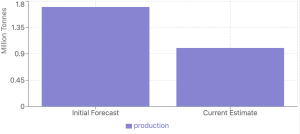

1. Production Estimates:

- Previous optimistic forecast (ABARES): 1.7 million tonnes

- Current trader estimates: Around 1 million tonnes

2.Market Dynamics

- Farmers are reluctant to sell due to crop damage

- Traders who went short (sold without stocks) are in a difficult position

- Focus is shifting to alternative sources, primarily Canada and Russia

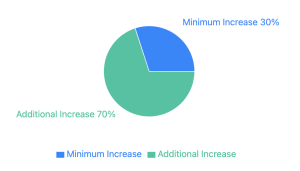

Global Price Trends

1. Red lentil prices have increased over the past four weeks:

- Maximum increase: 10% (Australian lentils to India, Nov-Dec delivery)

- Minimum increase: 3% (Russian lentils to Pakistan, Oct-Nov delivery)

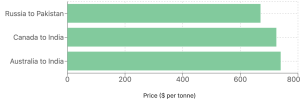

2. Current prices (per tonne, Cost and Freight):

- Russian red lentils to Pakistan: $670

- Canadian red lentils to India: $725 (Oct-Nov delivery)

- Australian red lentils to India: $740 (Nov-Dec delivery)

Outlook

- Despite price increases, Australia is expected to meet demand from India, Bangladesh, and Pakistan.

- Canada and Russia are positioned as alternative suppliers to fill any gaps in Australian exports.

Key Points

- Frost damage in Australia has significantly impacted red lentil production

- Global red lentil prices are on an upward trend

- Market focus is shifting to alternative suppliers like Canada and Russia

- The situation remains fluid, with potential for further market adjustments

This unexpected turn of events in Australia serves as a reminder of the volatile nature of agricultural markets and the impact of unforeseen weather events on global trade dynamics.